All Rights Reserved

WHAT THE COUNTRY MUSIC FOUNDATION DOESN'T WANT YOU TO KNOW!

Copyright © 2013 Stacy's Music Row Report

All rights reserved

In November, 2000, I contacted the Country Music Foundation requesting access to the CMF’s tax records. Six months prior to the May 17, 2001 opening of the new $37 million Country Music Hall of Fame and Museum (which the Foundation told the IRS would open April 1, 2000), I attempted to exercise every citizen’s right to see the 501 (C)(3) tax-exempt organization’s records.

My request came amid a city-wide controversy over CMF’s tax breaks and financing and was greeted with over four months of stonewalling and intimidation.

Intimidation came in the form of a certified letter, dated January 24, 2001, from Christian Horsnell, partner in the Nashville legal firm of Wyatt, Tarrant & Combs. Horsnell, a member of the Country Music Association with ties to Leadership Music, is vice-chair of his firm’s Intellectual Property Practice Group and one of his clients is the Country Music Foundation.

Horsnell wrote me that "The Country Music Foundation demands an apology." The nature of my transgressions was not specified, though the demand appeared to be an embarrassed response to the following statement from STACY’S MUSIC ROW REPORT: "It would seem that longtime employee DIANA JOHNSON, who has worked at the Hall longer than... [KYLE] YOUNG and several others, could file a convincing employment discrimination suit against the Foundation and the Country Music Association if she chose to do so." [The CMF is, in effect, a CMA subsidiary even though both the CMA and the CMF maintain a status as separate organizations. For similar insight into employment discrimination, read of my experience with the Country Music Association, (as documented in the article "What the Country Music Association Doesn’t Want You To Know" and "The Country Music Association: What is It Afraid of?"”) linked to this page.]

As I wrote Horsnell in a letter dated January 30, 2001, "In my opinion, the historical failure of the CMF Board‘s composition to reach anything approaching gender parity, despite the availability of many qualified women from which to draw, would give you some insight into my comments about Diana Johnson. Ms. Johnson’s tenure at CMF and the positions that she has and has not occupied during that time, speak to my opinion that she is an undervalued employee. CMF salary comparisons would be another barometer by which to bolster a case that, as I clearly wrote, could be best made by Ms. Johnson, should she choose to do so."

My letter followed a January 24th call to Chris, asking specifically who authorized him to write the letter he wrote in the CMF’s name.

Horsnell responded "The Country Music Foundation Board."

"All of the Board members?," I asked, skeptical not only that this was the case, but that the majority of CMF’s rubber stamp Board membership even knew that such a letter had been sent in their names.

Chris admitted my perception was accurate, but refused to admit that Hall of Fame Director Kyle Young was the anonymous instigator of this backfiring tactic that, judging by what attorneys charge to draft such letters, was just another example of how, under Young’s direction, the Hall of Fame wastes (in some cases taxpayers’) money.

As for following IRS procedure, this was a smokescreen and Horsnell knew it. Not only did Chris not specify what that procedure is, a look at the IRS rules indicates that there is more than one way in which to properly make a procedural request.

For example, one can make an in-person visit to the site of where the records are kept. But no one at that point would tell me where the records were held and I was not about to go downtown to the CMF's locked location, only to be told that the tax records were at the Music Row offices or vice versa.

When pressed, Horsnell said I needed to make a written request and at that point the CMF would be happy to accommodate me. But, as I wrote Chris on January 30, 2001, "Please note that on the several occasions when the CMF has declined to provide me the opportunity to inspect its 990s it has never ever cited as its basis for its noncompliance what you cite as my failure to follow IRS procedure."

Angered by the CMF harassment and Young’s apparent reliance on Horsnell to do Kyle’s dirty work for him, I told Chris that there would be no blanket apology for unspecified wrongdoing and that I still wanted to see the Country Music Foundation’s back tax returns. I also asked if his letter was a precursor to filing a lawsuit, because if it was, CMF should have at me.

Chris became very sheepish at that point, and justifiably so. That was the last I heard from him. Though a written request to view the CMF’s tax returns was sent to the CMF’s Deputy Director Nina Hammontree that day, it still took several weeks and another letter to the Internal Revenue Service’s Criminal Investigation Unit (with a copy of Horsnell’s threatening letter enclosed) before, at long last, on March 14, 2001, I was able to view the returns at the CMF’s soon-to-be downtown location.

Since the Foundation refused to provide me with photocopies of its returns, I was forced to make hand copies onto blank 990 forms that I had brought with me in anticipation of the CMF’s resistance.

On at least one of the returns, my blank forms and the CMF’s records did not line up. When I pointed out to Nina that a portion (Part VI, lines 76-92) of one of the CMF’s returns was missing, Hammontree said she’d have to look into it later. (Predictably, to date there has been no further response.)

--------------------------------------------------------------------------------

THE CMF's 1997 TAX RETURN The Country Music Foundation’s 1997 return includes statements that recur on subsequent returns as justification for the CMF’s tax breaks. The Foundation informs the Internal Revenue Service that during the tax year it "Assisted in promoting the advancement of country music while preserving its history and contributing to the education of the general public;" all this to the tune of $1,810,374 in program services alone. (The CMF’s net assets for the year were $9,174,242.)

The IRS neglected to ask the CMF if its mission to promote "the advancement of country music" is not a duplication of the Country Music Association’s mission. As for preserving country music’s history, what the CMF refuses to accept and what it, in effect discards, is indicative of the political process by which the Foundation educates "the general public" about the genre’s history. (How do invitation-only industry parties aid in this process?)

Another supporting statement on the CMF’s 1997 tax return is similar to the first and it too, recurs on subsequent year’s 990s: "The above activities have engaged the Country Music Foundation to promote country music and its preservation by providing the resources to educate the general public."

Long on repetition, short on specifics, the latter statement of purpose is as vague as the justification for the Foundation’s expenditures on salaries (these totaled $1,294,466), an earnest deposit ($1 million) and unspecified "other income" of $186,257.

Perhaps the earnest deposit was on the new Country Music Hall of Fame and Museum. The Foundation told the IRS, in consideration of a tax-exempt bond issue liability of $27 million bond, that it was for the "construction of a new museum due for April 1, 2000." (In reality, the Hall didn’t open until May 17, 2001; more than a year behind schedule, even with the city of Nashville’s lavish tax breaks).

The Foundation’s 1997 return divulges the existence of something called the Music Square Agency, though all that is indicated about the entity is that is nonexempt and somehow related to the CMF; though whether the organizations share membership, governing bodies, trustees or officers is not specified.

The return also reveals that the CMF owned $16,821 in corporate stocks.

During 1997, Bill Ivey’s last year as Foundation director, Ivey was paid a base salary of $162,600 excluding $9,756 in "contributions to employee benefit plans & deferred compensation."

Under Ivy gender pay disparity was quite clear. Bill’s favorite boy, Deputy Director Kyle Young (promoted from his position as museum ticket-taker) received a base salary of $76,600 and and $4,560 "contributions to employee benefit plans & deferred compensation," making Kyle the highest paid of the CMF’s four deputy directors. Two of these were women; all four worked the same number of hours and had the same job description (at least in terms of how CMF defined the positions to the IRS), though all four had different salaries, with Young earning $7,000 more than the lowest-paid deputy director and $4,400 more than the female deputy director who kept the CMF's books for the 1997 tax year.

--------------------------------------------------------------------------------

THE CMF's 1998 TAX RETURN During 1998, the Country Music Foundation received $7,112,603 in contributions and $86,000 from the government, for a total of $7,198,603 in contributions.

To these revenues Director Kyle Young added parking proceeds of $150,347 derived during the first year the Country Music Foundation charged it visitors to park in the CMF’s lot.

During 1998, the Foundation’s assets included $237,815, listed as the market value of its various stocks as the CMF maintained its unspecified business relationship with the Music Square Agency.

Kyle Young was named Foundation director during 1998. He received a base salary of $94,642 and $5,679 "contributions to employee benefit plans & deferred compensation" that year; a base salary of $67,958 less than outgoing Foundation director Bill Ivey received the year before and $14,358 less than the base salary of the CMF’s highest-paid director in 1998, Sam Hook. Hook received a base salary of $109,0000 and $6,540 in "contributions to employee benefits plans & deferred compensation."

Hook’s 1998 salary exceeded that of 1997 director Peggy Sherrill (the CMF’s Head of Accounting in 1998) as well as the salaries of the CMF’s four other deputy directors, who included Journal of Country Music editor Paul Kingsbury. Kingsbury is perhaps most famous for his comment to Southern Jewish History (a prestigious academic journal that rejects half of all submissions) that the history of Jews in country music is as significant as the history of "left-handers in country music," (despite the JCM’s recognition of the contribution of African-Americans and gays to country music. As editor, Paul selected the highly-politicized group of authors and entries represented in the CMF’s single volume country music "encyclopedia." He also authored a Grand Ole Opry history book heavy on non-Opry members.

The Country Music Foundation rewarded Kingsbury’s "scholarship" by paying him a base salary of $23,923 and $1,435 "contributions to employee benefit plans & deferred compensation." (Kingsbury and company proudly proclaim the Ford Motor Company as one of the new Hall of Fame and Museum's corporate sponsors, one of its movie theaters bears the Ford name in classic product placement, the CMF's multicultural thrust standing in stark contrast to the auto company's founder Henry Ford's well-documented history of antisemitism.)

--------------------------------------------------------------------------------

THE CMF's 1999 TAX RETURN So as not to get overly-involved in and overwhelmed by the repetition, minutiae and differing ways in which the Country Music Foundation categorized its income and expenses during the 1997-1999 tax years, I want to point to a couple statistics for the 1999 tax year alone: The CMF claimed (recurring) bad debt expenses of $64,647 in 1999 and a credit card expense of $20,897; this in addition to unspecified "other expenses" of $82,436.

During this same year the Foundation realized profits of $1,433,133 from ticket admissions.

Perhaps increasingly leery that its reporting practices were inviting an Internal Revenue Service audit, the CMF indicated on its 1999 return that it owns "100%" of the Music Square Agency, that the MSA, with end of year assets of $1,000, is involved in "public relations." Further, the CMF discloses that the Music Square Agency has a separate employer identification number and that the MSA received an income of $32,051 during 1999.

Inexplicably then, the CMF became more secretive furnishing its statement of 1999 salaries to me. These salaries were only listed in the aggregate to me ($591,720 in compensation and $33,435 in "contributions to employee benefit plans & deferred compensation"), but presumably not to the IRS.

To the CMF's consternation, I have independently verified that during 1999 Kyle Young received a base salary of $155,194 and $9,042 "contributions to employee benefit plans & deferred compensation." This amounts to a $60,552 raise in Young’s 1998 salary.

Once again, Sam Hook, employed by the Foundation nowhere near as long as Diana Johnson, was the highest paid of the Foundation’s deputy directors during 1999. Hook received a base salary of $80,991 and $4,847 contributions to employee benefit plans & deferred compensation, a pay cut of $18,009 from Sam’s 1998 income."

Hook’s pay cut effectively makes former Country Music Hall of Fame ticket-taker Young the Foundation’s highest-paid employee, though Sam still earned more than four other deputy directors including Nina Hammontree and Diana Johnson as well as head of accounting Peggy Sherrill.

Sam’s pay also exceeded that of Paul Kingsbury. Kingsbury’s pay inexplicably increased $34,077 from his 1998 income, as he received a 1999 base salary of $58,000 and $3,390 "contributions to employee benefit plans & deferred compensation."

--------------------------------------------------------------------------------

Remaining Questions As I surrendered copies of the CMF’s 990s to Nina Hammontree on March 14, 2001, I had four preliminary questions of her:

1, Did the Country Music Foundation knowingly withhold from me, as is its legal right, certain pages of its return that it is not required to submit for public inspection? If so, what year(s) are at issue and what is the nature of the information not provided?

2. Why was Part VI (lines #76-92) missing from one of the returns?

3. Did the Country Music Foundation/Music Square Agency file a separate return for the Music Square Agency during the tax years 1997-1999 and, if so, could I be provided access to these records?

4. Why were salaries on the 1999 return, as provided by the Foundation to me, listed in the aggregate rather than individually? https://info.muckrack.com/hubfs/Email%20images/3.8.2023_state%20of%20journalism%202023_FINAL.pdf

On April 30, 2001, still awaiting Nina’s response to those questions, I submitted these additional queries:

1. It is my understanding that Foundation Board members pay their own travel expenses. If this is correct, why does the CMF claim travel expenses on its tax returns?

2. What is it that requires earnest deposits each year?

3. Why does the Foundation own corporate stocks?

4. What is the nature of the bad debt expense that CMF claims each year? Who were the debtors?

5. What specific expenses were claimed as “other expenses” for the years 1997-1999?

8. Why does the CMF carry a credit card and which CMF officials are allowed to use the credit card?

9. What is the Music Square Agency? Why does it have a separate EIN but share the CMF’s address? Do the figures corresponding to the MSA represent payment to Liz Thiels? (Elizabeth Thiels has been the longtime Country Music Foundation publicist, maintaining a very strange relationship with CMF.)

10. Is a separate tax return filed for the MSA?

11. What accounts for the disparity in pay between directors working the same hours and occupying the same position?

As those questions are

answered, this page will be updated.

- Have

a comment or a question? First please check the FAQs page (where you'll

learn of Iceberg's identity) linked to this Report. Then feel free to

respond to Stacy Harris by clicking here.

STACY

HARRIS IS ON THE MAP!

READ THE PUFF PIECES AND THE HATCHET JOBS, THEN COME TO THE SOURCE FOR

THE REAL DEAL!!!

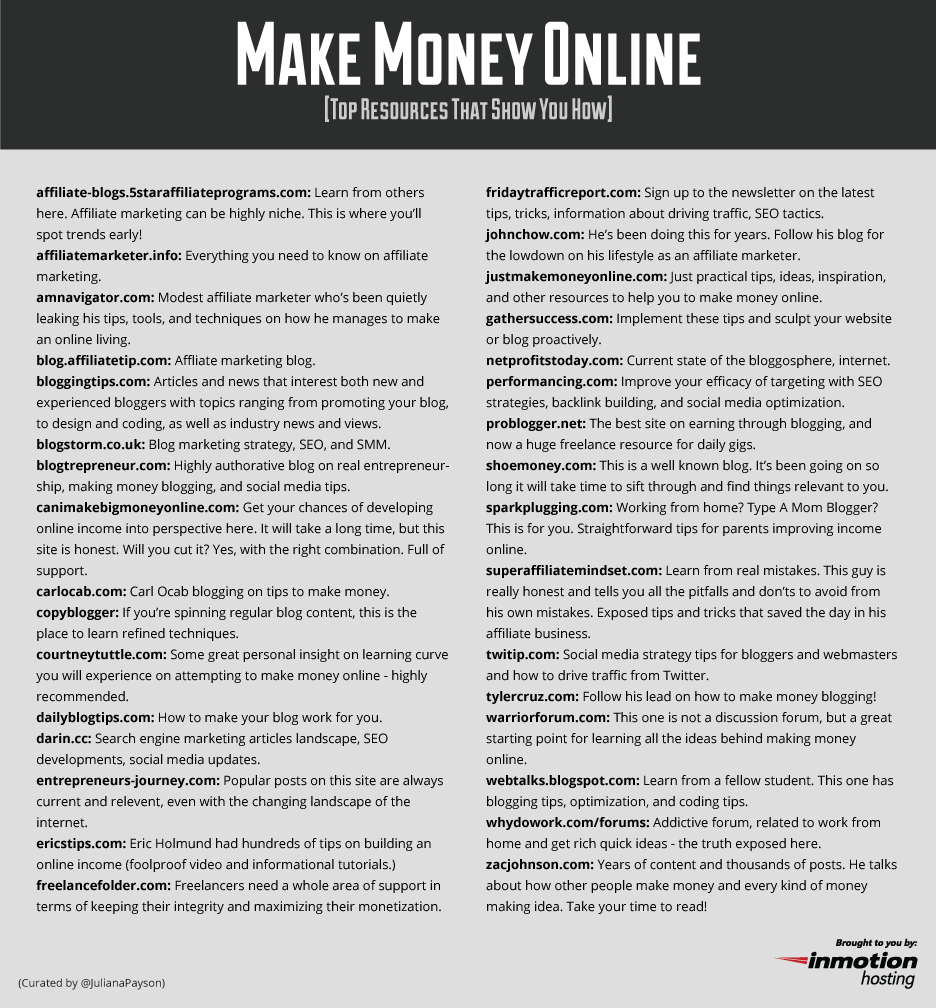

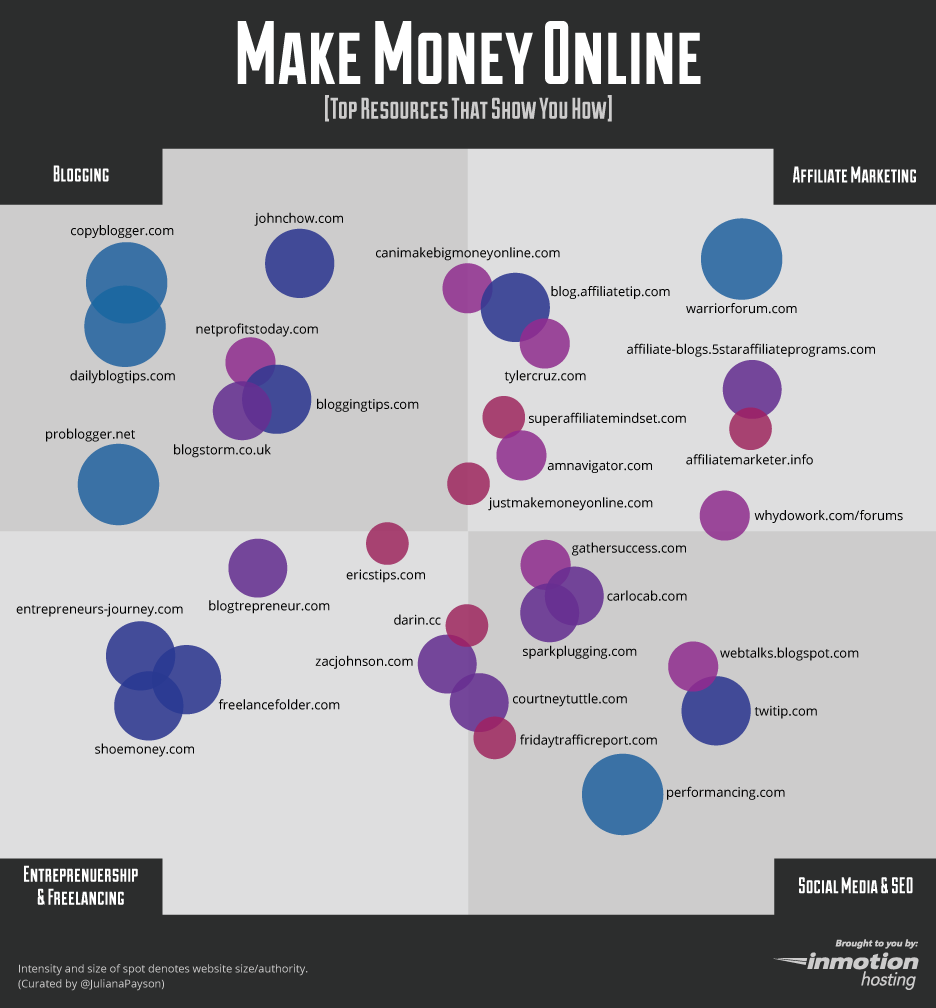

Infographic of WordPress Essentials by

Industry – Brought to you

from InMotion Hosting – A VPS

Hosting

Provider

Top Resources for How to Make

Money Online – Brought to you

from

InMotion Hosting – A VPS

Hosting

Provider

Home | Music Row Report | Music Reviews | Book Reviews | Paid Content | Contact